Budgeting Tips for New Moms

The nine months prior to the arrival of your baby can be an incredibly stressful time regardless of whether you planned for your pregnancy or not. Planning for a new family member affects all aspects of life, especially your finances. There are a lot of supplies to collect, like cribs, clothing, diapers and the like.

We tried to streamline the process of the baby budget by providing you with an in-depth guide on how to approach this new chapter of your life and welcome the newest member of the family.

What Are the Costs?

The Health Care Cost Institute states that the average hospital bills for having a baby are roughly $14,066. This figure unfortunately doesn’t account for prenatal and wellness appointments preceding delivery. Luckily, this is the most expensive cost for a baby’s first year. Following the delivery, the first year of the baby’s life will likely cost a middle income family $12,980, according to the USDA.

There are plenty of strategies to offset these costs and take them head on. Budgeting with priorities can help you discover how much money you need to save or how much you should take out in loans.

Budgeting is Your Best Friend

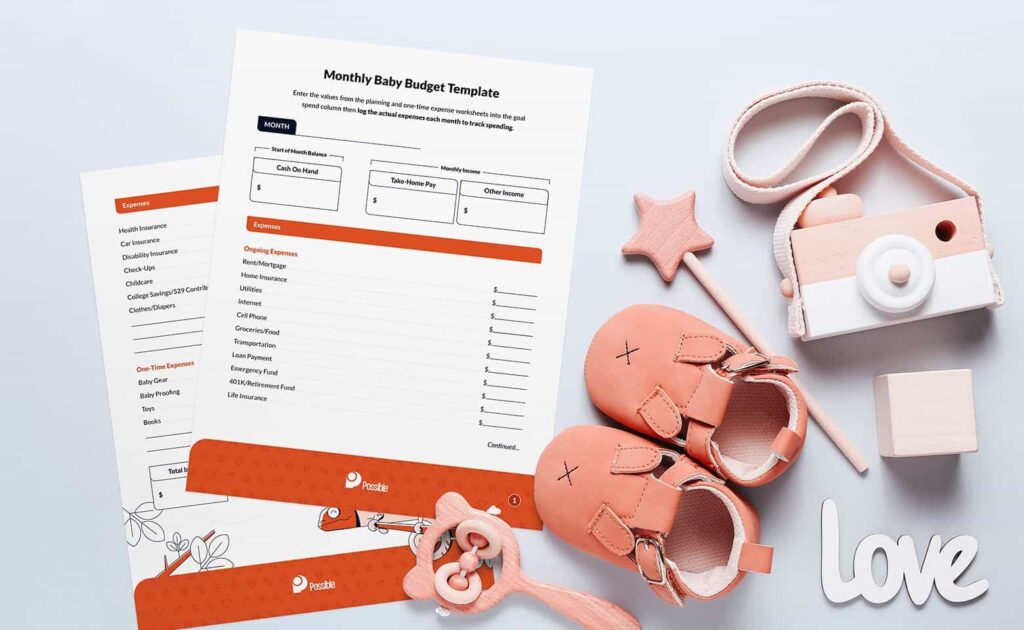

Demystify where your money is going with a thorough baby budget. We’ve provided templates for you to use so that the process is that much easier. They break down the step-by-step process of what you should consider necessities versus what items are simply nice to have. Here’s the breakdown of these templates:

Step 1. One-Time Costs Checklist

These checklists show the different expenses you may encounter during your baby’s first year. Once you’ve outlined what your baby’s needs are, you can dedicate a set amount of surplus funds to the “nice-to-have”s each month.

Costs Checklist PDFSend download link to: |

Step 2. Baby Budget Planning Worksheet

Using this worksheet, budget the first year of expenses and make sure to note them as a one-time expense. Once you’ve multiplied each expense by the times per month you incur them, you can find the total for each category. The last step is simply entering the final values into the baby budget template.

If you would like to work with Excel, Click here to access the spreadsheet

Step 3. Baby Budget Template

The third and final step is to enter the values from Step 1 and 2 into the goal spend column in the Baby Budget Template. When it comes time to make those purchases, make sure you log the actual expenses monthly in the following columns so that you can track your spending and consequently adjust your budget as the data comes in. Babies are an investment, so planning ahead through budgeting can make a stressful transition run a bit smoother. We hope that these baby budgeting tips will help you manage your finances easier once you welcome your newest family member into the world.

If you like this post and you would like to read more content like this, please subscribe to our mailing list here

- Things to Do in West Palm Beach with Kids - February 8, 2026

- 5 Tips to Boost Your Child’s Immune System - February 5, 2026

- Exploring Miami with Kids: A Canadian Family’s Winter Escape - January 6, 2026

Facebook Comments